Tribal Loans for Really Bad Credit: A Lifeline When Traditional Lenders Say No

When Credit Scores Hold You Back, There’s Another Way

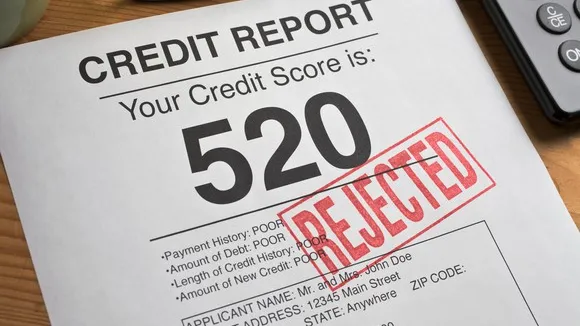

A low credit score can feel like a locked door, keeping you from the financial relief you desperately need. Whether it’s an unexpected medical bill, urgent car repairs, or simply making ends meet, access to fast funding is crucial. Tribal loans for really bad credit offer a potential alternative when banks and mainstream lenders shut their doors. But how do they work? Are they safe? And what should you know before applying?

This deep dive into tribal lending uncovers everything you need to know, equipping you with powerful insights to make informed financial choices.

Why Traditional Lenders Turn Their Backs on Low Credit Borrowers

Banks and credit unions rely on strict credit scoring models. If your credit score doesn’t meet their threshold, you’re automatically disqualified, regardless of your current financial situation. Many borrowers with bad credit face endless rejections, leaving them with few, if any, lending options.

But what if an alternative exists—one that doesn’t judge you solely by past mistakes? This is where tribal loans enter the picture.

What Are Tribal Loans and How Do They Work?

Tribal loans are personal loans offered by lenders owned by Native American tribes. These lenders operate under tribal sovereignty, meaning they may not be subject to the same state regulations as traditional banks and payday lenders.

Unlike conventional loans, tribal loans:

-

Are accessible even with extremely low credit scores

-

Provide quick approval and funding, sometimes within 24 hours

-

Feature flexible qualification criteria, prioritizing income over credit history

-

Can be applied for entirely online, eliminating complex paperwork

For borrowers struggling with bad credit, tribal loans offer a pathway to financial relief without the traditional roadblocks.

Are Tribal Loans Safe? Separating Fact from Fiction

Concerns about lending practices are valid, and tribal loans are no exception. While many reputable tribal lenders operate transparently, some engage in predatory lending. Understanding the key factors that separate reliable lenders from risky ones is essential.

Signs of a Trustworthy Tribal Lender

-

Affiliation with a recognized Native American tribe: Legitimate tribal lenders are backed by federally recognized tribes.

-

Clear disclosure of terms and fees: Interest rates, repayment schedules, and fees should be transparent.

-

Compliance with federal laws: While tribal lenders may not follow state regulations, they must adhere to federal consumer protection laws.

-

Strong customer reviews: Look for feedback from past borrowers to gauge credibility.

Red Flags to Watch Out For

-

Hidden fees or unclear repayment terms

-

Excessively high-interest rates beyond industry norms

-

Aggressive collection tactics

-

No visible tribal affiliation or contact information

Choosing a reputable lender ensures you receive fair terms and avoid potential financial pitfalls.

How to Apply for a Tribal Loan with Really Bad Credit

Getting approved for a tribal loan is often simpler than applying for a traditional loan. Follow these steps to improve your chances of securing funds:

-

Verify lender legitimacy: Ensure they are affiliated with a federally recognized tribe.

-

Check eligibility requirements: Most lenders require proof of income, a valid ID, and an active bank account.

-

Compare loan terms: Review interest rates, repayment schedules, and total loan costs.

-

Submit an online application: The process is usually quick and straightforward.

-

Receive funds: Approved borrowers often get their money within 24 to 48 hours.

Understanding Interest Rates and Repayment Terms

Tribal loans tend to carry higher interest rates than traditional personal loans. However, they generally fall between payday loans and installment loans in terms of affordability.

-

Short-term tribal loans: Higher APRs, smaller loan amounts, quick repayment schedules.

-

Installment tribal loans: Larger loan amounts, extended repayment terms, lower APRs compared to payday loans.

Before accepting any loan, calculate the total repayment amount to ensure it fits within your budget.

Are Tribal Loans Better Than Payday Loans?

For borrowers with bad credit, payday loans might seem like the only alternative. However, tribal loans offer several advantages:

-

Longer repayment terms: Unlike payday loans that require lump-sum repayment, tribal loans often allow installment payments.

-

Lower overall cost: While still expensive, many tribal loans have lower interest rates than payday lenders.

-

More flexible eligibility criteria: Income-based approval rather than strict credit requirements.

When used responsibly, tribal loans can be a more sustainable borrowing option than payday loans.

Alternatives to Tribal Loans

Before committing to a tribal loan, consider other options that may provide better financial flexibility:

-

Credit union loans: Some credit unions offer small-dollar loans with reasonable terms.

-

Secured personal loans: Using collateral can increase approval odds and lower interest rates.

-

Peer-to-peer lending: Online platforms connect borrowers with individual lenders for fairer rates.

-

Negotiating with creditors: Some creditors offer hardship programs or modified payment plans.

Making the Right Choice for Your Financial Future

When traditional lenders say no, tribal loans for really bad credit provide an alternative lifeline. However, it’s crucial to approach them with awareness. By choosing reputable lenders, understanding repayment terms, and exploring all available options, you can make an informed financial decision that aligns with your long-term stability.

If you’re considering a tribal loan, take a moment to evaluate your budget, compare lenders, and ensure the loan will truly meet your needs without leading to further financial strain. Smart borrowing is the key to overcoming financial hurdles without falling into deeper debt.

Tonka Bluebird

Author

Tonka is part of the Navajo tribe and has an advanced master degree in finance and economics and has been in the financial industry for over two decades and brings that knowlefe and experience to our blog.